Derivatives Support Analyst

Derivatives Support Analyst

THE WORK:

- Manage Collateral Processes – Oversee the end-to-end collateral management process, ensuring accuracy, compliance, and timely execution across all relevant accounts.

- Report on OTC Positions – Prepare and deliver reports on all OTC derivative positions, incorporating client-specific pricing data and ensuring data integrity.

- Reconcile andamp; Confirm Trades – Conduct reconciliation, matching, and confirmation of OTC derivative trades with counterparties to ensure trade accuracy and reduce operational risk.

- Monitor Risk andamp; Limits – Track and report on counterparty exposure and limits, identifying potential risk areas and escalating issues as needed.

- Coordinate with Key Stakeholders – Collaborate with Front Office, Technology, Risk, and external stakeholders to resolve issues and ensure smooth operational workflows.

WHAT’S IN IT FOR YOU?

- Front-Row Seat in Financial Markets – Work at the heart of capital markets operations, gaining valuable exposure to OTC derivatives, collateral management, and risk monitoring.

- Collaboration andamp; Cross-Functional Learning – Partner with diverse teams including Front Office, Risk, and Technology, expanding your understanding of end-to-end financial operations.

- Career Growth andamp; Skill Development – Enhance your analytical, reporting, and stakeholder management skills in a dynamic, fast-paced environment with strong learning potential.

The work location for this role includes a mix of working remotely and in an Accenture office in Warsaw (50/50 hybrid model).

With all our roles, there is some in-person time for collaboration, learning and building relationships with clients, peers, leaders, and communities. As an employer, we will be as flexible as possible to support your specific work/life needs.

HERE’S WHAT YOU’LL NEED:

- OTC Derivatives Knowledge – Solid understanding of OTC derivatives, including trade lifecycle, reconciliation, and related risk factors.

- Relevant Work Experience – 2–3 years of experience in collateral management or repo collateral operations, ideally combined with exposure to asset servicing.

- Analytical andamp; Technical Skills – Strong Excel skills with the ability to manage large data sets and perform in-depth analysis.

- Educational Background – Degree in Business, Finance, or a related field — or equivalent hands-on experience in a similar role.

- Language Proficiency – Fluent English skills (C1 level), with the ability to communicate clearly and professionally in a global environment.

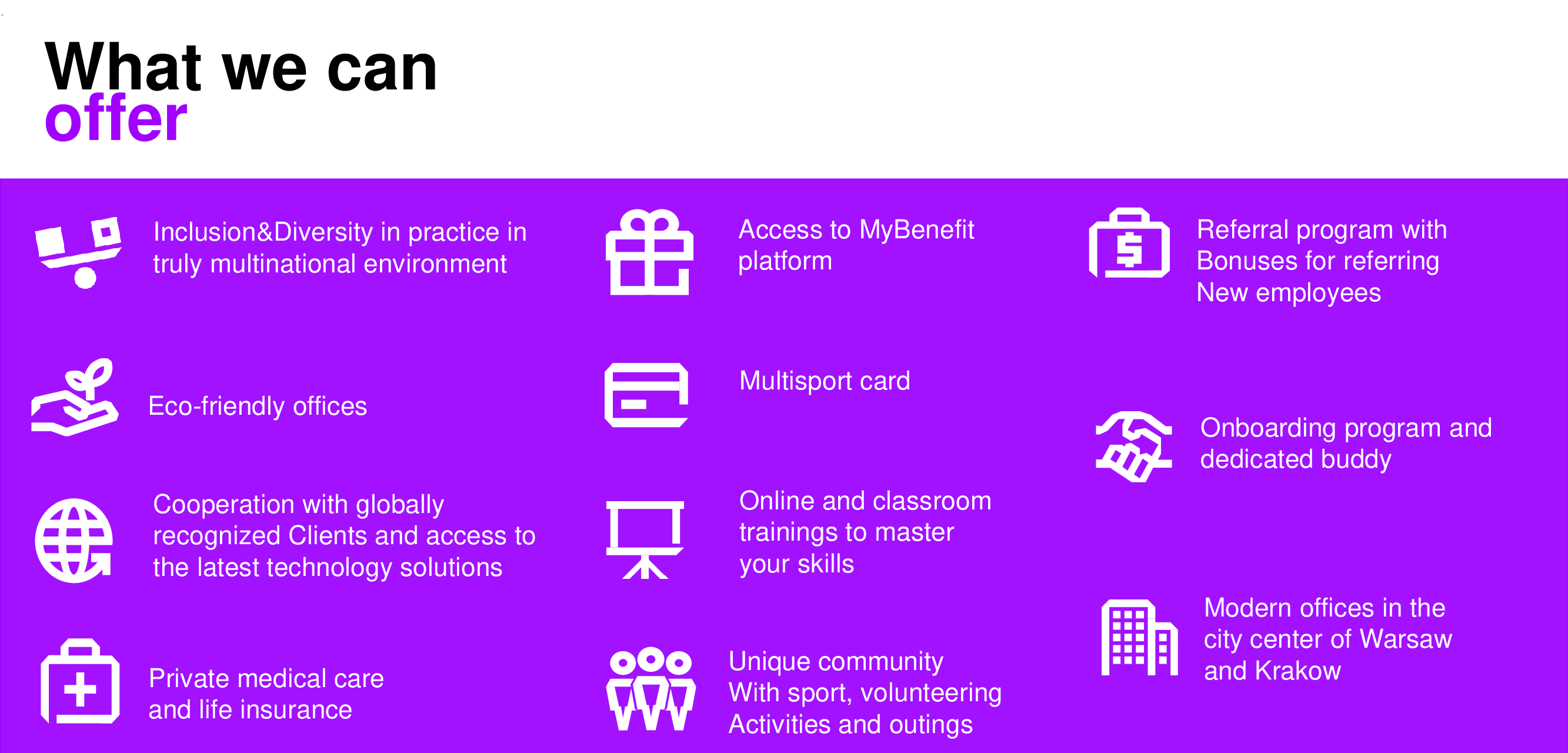

What we can offer

- Inclusion&Diversity in practice in truly multinational enviroment

- Eco-friendly offices

- Cooperation with globally recognized Clients and access to the latest technology solutions

- Online and classroom trainings to master your skills

- Onboarding program and dedicated Buddy

- Unique community with sport, volunteering activites and outings

- Access to MyBenefit platrofm

- Multisport and lunch card

- Private medical care and life insurance

- Referral program with bonuses for referring new employees

- Modern office in the city center of Warsaw

- Chill room, game room, library and coffee-breaks at terrace